FINANCIAL PLANNING

Financial Freedom

The key to financial freedom and great wealth is a person's ability or skill to convert earned income into passive income and/or portfolio income.

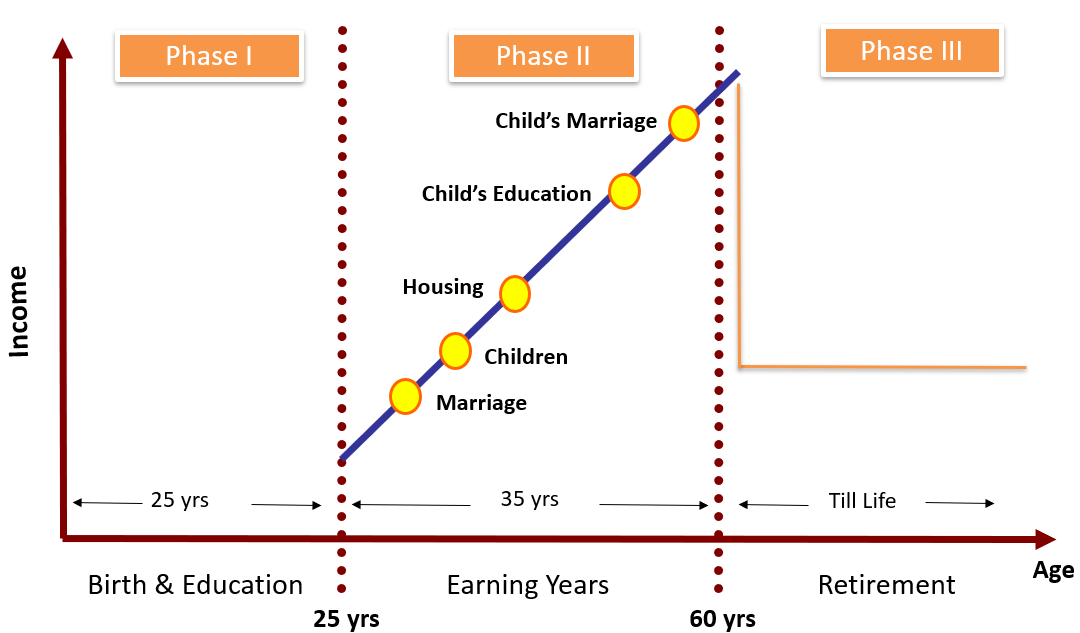

Life Cycle Stages

The choices that you make today impact your future!

Life cycle - a series of stages through which an individual passes during his or her lifetime.

a series of stages through which an individual passes during his or her lifetime.

We follow a multi-disciplinary method of wealth management and mutual funds are a part of that. Yam Financial consultancy helps the clients in mutual fund distribution & management with proper guidance and personalized investment solutions.

We are aggregated mutual fund distributor with all of the leading mutual fund providers. Our clients are provided with anytime access to their portfolios and regular reports are shared on a predefined frequency.

Mutual Fund Advice

We help the investors in understanding mutual funds and why one should invest through mutual funds.

Further to this, we provide guidance in picking the best mutual fund as per their financial plan and also educate our investors on how to monitor their mutual fund investments.

YAM Financial Consultancy believes in empowering the investors and that is why we help our clients in evaluating the mutual funds and how they can earn better returns from their Mutual Fund portfolio.

The idea is to help you by providing, the appropriate and Best Mutual Fund advice as per your financial goal & Risk appetite

Types of Mutual Fund

1) Equity Mutual Fund

2) Hybrid Mutual Fund

3) Debt Fund

With evolving regulations and financial challenges, planning for your retirement can be quite a daunting task. Planning for your retirement requires you to look at the investment’s lifecycle and also at the end user requirements. At Wealth Anand, we work along with our clients in providing a retirement solution that spans across platforms, ensuring benefits for the entire cycle of retirement, providing them with insights to improve on their future planning.

It is important as part of your retirement planning, that you do not give up on your lifestyle or your living conditions. Yet to do so, you need to plan well in advance. Your earnings today should become savings for the future without compromising on the present living conditions as well. At Wealth Anand, we will help invest in a fund that will help you with the best returns on your retirement. We help you attain your long term financial objectives with insights on the market and help you to make informed decisions for your future.

Retirement Planning

If you are looking for a method to save for your retirement that will also be tax effective then, superannuation is definitely your solution. With living standards rising every day, you have to ensure that your money works while you rest.

The Superannuation is a sector that keeps evolving everyday with changes in regulatory environment which means you need to plan in advance for any deviations in future.

At Wealth Anand, we ensure that your superannuation benefits are maximized so that your hard earned money helps in providing for your better future. With our experience for nearly a decade, we can help you find the plan that will have optimal benefits with minimal fees and a better retirement plan.

Plan your retirement today and enjoy unlimited benefits after retirement!

Apply now

Education costs are on the rise and continue to be on the high end each year. As your kids grow old and start pursuing higher education, there is a significantly higher education costs involved. And you are definitely not going to forbid them from pursuing their interests for want of money now, do you? In this day and age, as you plan your finances, you also need to plan for their higher studies.

At Wealth Anand, we help bring your child’s dreams come true.

Know your needs

Financial planning is the act of managing your income; setting your financial goals and then allocating your assets across

Every financial planning starts with knowing your requirements. In case of education planning, you first need to determine your objectives and know what you need.

Wealth Anand starts with questioning our clients on their requirements to get a better understanding of your needs. We help you choose between private or public schools, the cost that you can afford, how long you can sustain the cost, the time you need to save, and when you need the money and so on.

Every financial planning starts with knowing your requirements. In case of education planning, you first need to determine your objectives and know what you need.

Wealth Anand starts with questioning our clients on their requirements to get a better understanding of your needs. We help you choose between private or public schools, the cost that you can afford, how long you can sustain the cost, the time you need to save, and when you need the money and so on.

Factors that can have an effect on the education

There are multiple factors that can bear on the cost of the education and the amount that you want to save. Few factors that can have a bearing include,

• Age of the student

• The performance of the student in academics.

• Scholarships that the student can garner.

• The education that the student wants to pursue.

• Cost of accommodation.

• Age of the student

• The performance of the student in academics.

• Scholarships that the student can garner.

• The education that the student wants to pursue.

• Cost of accommodation.

When you are planning for the higher education of your child, the earlier you start, the better your chances of making more in the savings account. With an experienced financial advisor at your side, you will be able to determine well on how to fit your educational goals into your financial planning.

If you are looking for your children to have the best option for their higher education, contact Wealth Anand Advisors now!

Apply now

Everyone wants to be able to provide and protect those they love. This is why you need to protect and preserve your assets not only during your lifetime but also beyond it. This way you can make sure that your loved ones are protected and they are able to enjoy the assets even after your lifetime.

At Navneet Dhawan, we help you to plan your estate, working alongside your lawyers, accountants and other related personnel ensuring that you have an efficient and sound strategy is in place. The planning of your estate, is also an important step in achieving your personal objectives and the goals you have for your family financially. With proper planning of the estate you are ensuring that your financial as well as your legal affairs are easier to handle with. And it can also help you to plan well on the tax front, optimizing your tax returns.

Estate planning services

There are many ways one can plan their estate and Navneet Dhawan offers you all the above options and more for your benefit.

a) Living will services: We offer you assistance in drafting your will and help with the execution of the same. We also offer you consultation to make your own will and generate it yourself.

b) Joint ownerships: If you are looking to make your property into joint ownerships then we can assist you in drafting the necessary documents and in handling the legal formalities surrounding the same.

c) Power of attorney: If you want to hand over the reins to someone for a certain period of time, then POA (Power of Attorney) is the right option. We shall help you make the necessary changes to ensure a smooth handover to your trusted and loved ones with minimal interference from you.

Apart from the above, we also help you with beneficiary designations, creating revocable trusts and more.

Apply now

© Copyright 2024. www.dkinvesto.com. All rights reserved.